As long as they understand what insurance is and how it benefits them, young people should consider getting one. Photo by Baim Hanif on Unsplash.

Youths in this day and age have a myriad of concerns.

Before even thinking of getting married, for instance, they wonder if they can find a well-paying job, afford their own private transport or home, save as much as they can to go on holidays or buy the latest mobile device, and earn enough to pay off their loans or cover their daily expenses.

So perhaps the last thing they have in mind is to buy and maintain an insurance or two. They might even reject the idea of getting an insurance in the first place.

They probably think insurance is unnecessary because they are still healthy and have financial support from their parents. They might also have preconceived notions of insurance being expensive, a scam or important only as they enter their later stages of life.

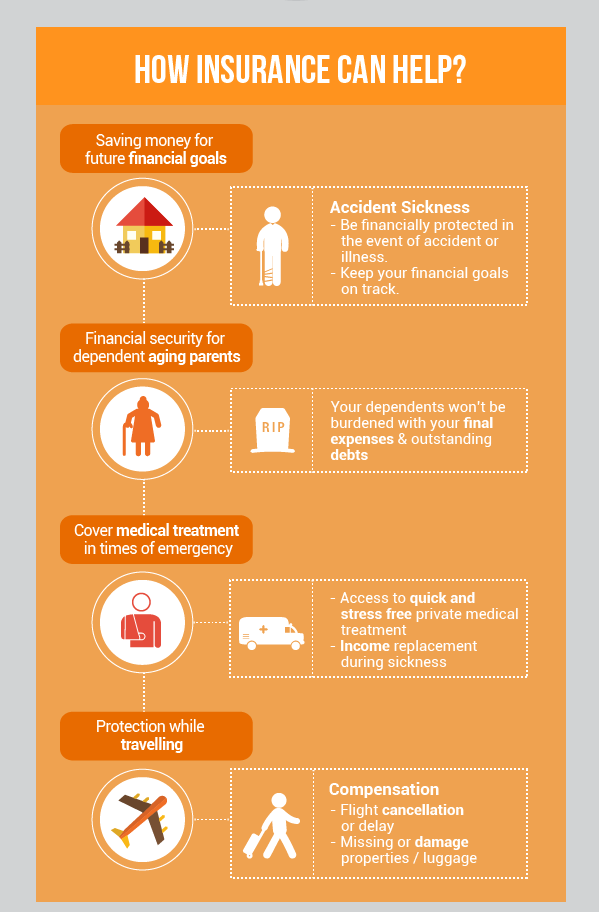

However, as AIA Malaysia explains in a series of articles on debunking these misconceptions, youths should be adequately insured regardless of their age and priorities, because life’s unpredictability can affect their finances and journey towards their life goals.

Investopedia defines insurance as “a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company.”

In Malaysia, common types of insurance include life insurance, medical insurance, car insurance, home insurance, travel insurance and personal accident insurance.

Insurance can be greatly beneficial for youths. The earlier they start investing in one, the more opportunities they have in securing a cheaper premium, allowing them to better plan their finances thanks to higher savings.

Speaking of opportunities, youths who are still in good health have more options in selecting a comprehensive insurance coverage, for insurance rates tend to rise and the range of plans shrinks as they grow older and become more susceptible to illnesses.

By investing in the right protection plan early, youths will have the financial security they need to overcome challenges that could cost their entire savings and life plans.

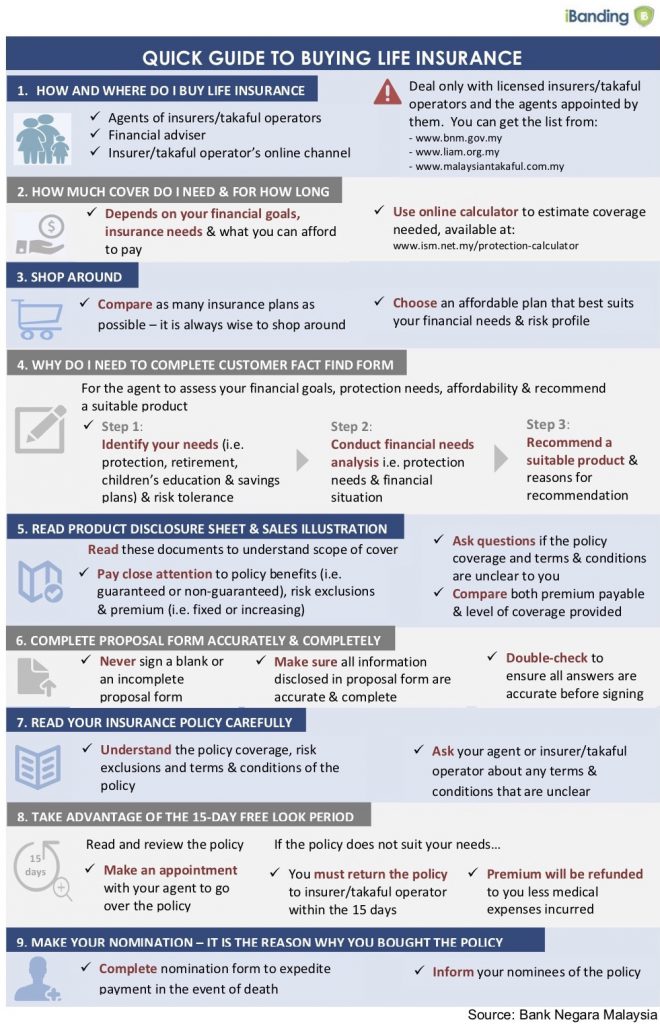

The key is to understand how insurance work. This is where financial literacy comes in, because having the knowledge, skills and confidence to make financial decisions responsibly allow consumers, especially youths, to make choices best suited for them regarding insurance planning and coverage.

“A discussion of insurance terms and descriptions of the features of different types of insurance can enable the consumer to determine which insurance products are appropriate for his or her individual situation.

“Information on ‘tips and traps’ can help the consumer to evaluate the various insurance products offered and to select the best provider of these insurance products,” notes the Organisation for Economic Co-operation and Development (OECD), adding that these knowledge is vital as new insurance providers enter the industry and increasingly complex insurance products are introduced.

One way for youths to identify insurance coverage options that meet their needs is to work hand in hand with a licenced financial adviser to better navigate the wide range of insurance products available in the market.

In finding their preferred protection plan, youths will need to determine their budget and commit to it to take advantage of the financial benefits that insurance offer without being shackled by high premiums.

Encouraging Malaysians to Get Insured

If you’re new to purchasing insurance, you can get started by considering basic protection plans that are provided under Perlindungan Tenang.

Launched in 2017, the national initiative is a collaborative effort between the Central Bank of Malaysia (BNM) and the Malaysian insurance industry to incentivise more Malaysians, especially B40 communities, micro-enterprises and youths, to get insured.

As of 2020, the life insurance penetration rate in Malaysia accounts for around 54 percent, which hasn’t changed much for the past five years.

Industry associations such as the Life Insurance Association of Malaysia (LIAM) cited the lower-income group or the B40 as the main reason behind the low penetration rate. Many from this group do not have any life insurance coverage and depend solely on their income to cover their daily expenses.

“Among the entire B40 group, perhaps only 10 percent of them have life insurance coverage,” says chief executive officer of LIAM Mark O’Dell, as quoted by the Edge Markets.

Perlindungan Tenang aims to address problems that hinder Malaysians from getting insured by establishing a platform where participating insurers and takaful operators offer basic protection plans that are affordable and easy to understand, as well as provide a convenient claims process.

These products carry the Perlindungan Tenang logo, and are available at various distribution channels, such as online platform, mobile phone, banks, agents, walk-ins and post offices.

Up to eight million working-age Malaysians and more than 700,000 micro-enterprises who are in need of insurance and takaful plans as safety nets against key risks are to benefit from the initiative.

Most importantly, Perlindungan Tenang hopes to empower B40 communities to protect themselves and their families by introducing proper financial planning that will benefit them in the long run.

Under the national 2021 Budget, the Malaysian Government introduces the Perlindungan Tenang Voucher Programme as a form of social protection for B40 households, in which aid recipients receive a RM50 voucher to buy products listed under the initiative.

“The industry hopes that through this incentive, it would benefit about 12.8 million of B40 households in the country.

“Ultimately, it would help to fulfil the nation’s aspiration of insuring 75 percent of the population and accomplish the industry’s financial inclusion agenda,” said LIAM in a press statement responding to the tabling of the 2021 budget.

Find out more about protection plans under Perlindungan Tenang via LIAM, the Malaysian Takaful Association and the General Insurance Association of Malaysia.

Read more: Financial Literacy for Youth

Read more: Literacy enrichment for young adults