The four spheres of financial literacy are earning, spending, saving, and investing. (Credit: rawpixels)

Understanding money and making wise financial decisions is crucial for a stable and fulfilling life. Financial literacy, the ability to manage money, is especially important for the current generation of youths amidst fast-paced economic changes. This article explores the basics of financial literacy, the current status among Malaysians, and existing initiatives to enhance financial know-how.

Financial Literacy: The Basics

Financial literacy involves having the skills and knowledge to make smart money decisions. For young Malaysians, this means learning to manage their money, create budgets, and understand the basics of saving and investing. Being financially literate helps you pay bills on time, avoid debt, and save for important life goals.

Financial Literacy Gap in Malaysia

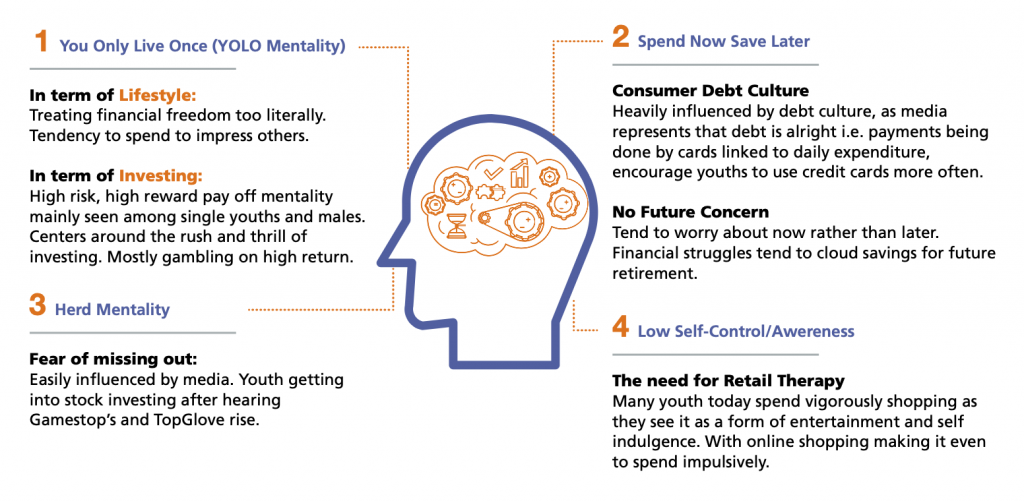

Sadly, several nationwide surveys reveal that many Malaysian youths face challenges when managing their money.

Shocking 2022 statistics from the Credit Counselling and Debt Management Agency (AKPK) reveal that out of 382,761 participants in debt management programs, a significant 210,409 were between 20 and 40 years old. Furthermore, between 2018 and 2022, 57% of the 48,791 people declared bankrupt were below the age of 44, according to the Federation of Malaysian Consumers’ Associations.

The COVID-19 pandemic has intensified financial matters for Malaysian youths. The Royal Malaysian Police (PDRM) recorded 71,833 financial scams between 2020 and 2022, resulting in a staggering RM5.2 billion loss. The impact of this pandemic has made it even more evident that having a good understanding of finances is crucial. The situation has shifted the public perspective on investments, showing they can be an opportunity for alternative income.

Why Financial Literacy Matters

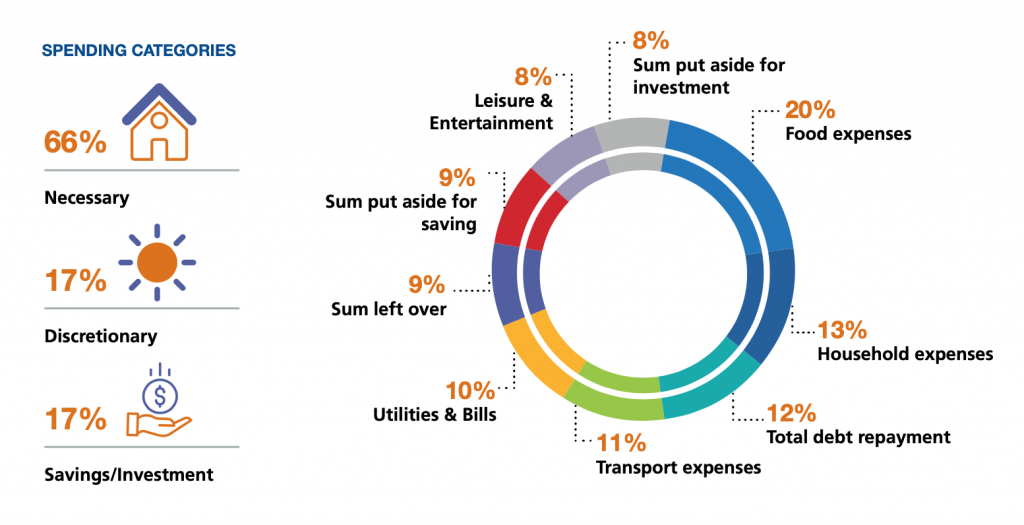

Knowing how to handle money is vital for a stable and secure future. Financial literacy reduces the chances of falling for scams, and they help in decision-making for better quality of life. The financial choices you make in your youth can have a lasting impact, especially with today’s challenges like rising student loans and the temptation of consumerism.

Many young Malaysians need guidance in managing their money due to a lack of financial curricula and exposure to poor financial practices. Low-income households often have lower levels of financial knowledge, widening the gap between different socioeconomic groups.

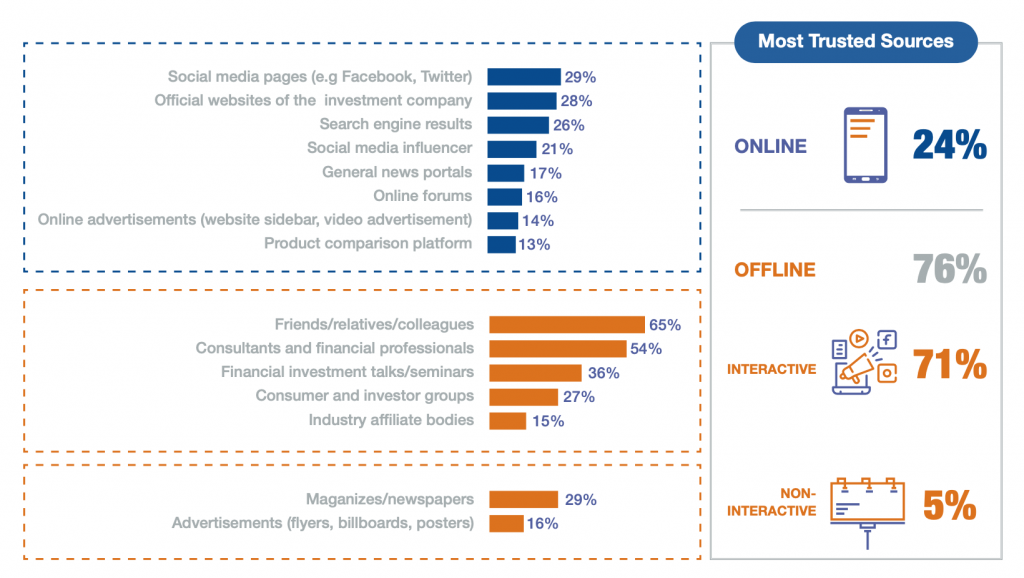

That is why making financial literacy engaging and easy to understand is critical. Digital literacy training is crucial, given the rise of online financial platforms. Trusted sources like financial advisors and interactive seminars are the key to educating young Malaysians about finances.

Initiatives and Resources

Recognising the importance of financial literacy, the Malaysian government has taken steps to increase public access to financial information:

- Financial Education Network

An interagency platform comprising agencies like the Ministry of Education Malaysia and Bank Negara Malaysia. They provide financial education resources and updates for upcoming programmes. - AKPK Online Learning Portal

An online learning portal developed by AKPK to provide public-assessable financial education programmes for all economic levels.

Several non-government platforms also provide valuable information and tools for managing personal finances:

- Financial Literacy for Youths (FLY: Malaysia)

An initiative to spread awareness of the importance of financial knowledge. They provide financial education resources and insights into the Malaysian industrial work context. - Smart Investor Malaysia

A financial insight platform that provides Malaysian financial institution-approved reading materials to help investors plan their investment strategies.

- RinggitPlus:

Malaysia’s leading financial comparison website. They excel in simplifying the application process of financial products through their in-house digital tools. - Versa:

A digital cash management platform with interest rates on par with fixed deposits. They remove common obstacles such as lock-in periods and offer convenience and flexibility for users. - iMoney:

A personal finance company’s comparison platform with proven extensive experience in empowering people to reach their financial goals with innovative services and solutions. - MyPF:

An award-winning financial education platform for Malaysians to simplify and grow their finances. They provide financial solutions, connection to licensed financial planners, and regular awareness events.

No matter the age or economic status, mastering money is essential to live a sustainable life. Government efforts and innovative approaches from various platforms can empower young Malaysians to make informed financial decisions. By building financial resilience, Malaysia can ensure that its youth can navigate the complexities of the modern financial world.

References

- “Youth Capital Market Survey — A Malaysian Perspective” by Suruhanjaya Sekuriti (Securities Commission Malaysia), 2022

- “Malaysian Financial Literacy Survey 2021” by RinggitPlus

- “MALAYSIA National Strategy for Financial Literacy 2019-2023” by Financial Education Network (FEN)

- “Do We Have Common ‘Cents’? Malaysia’s Low Levels Of Financial Literacy” by WikiIMPACT, 2023

- “Inculcate financial literacy in youths” by New Strait Times, 2023

- “Futureproofing Malaysians with Financial Know-how” by Smart Investor Malaysia, 2022

- “Instilling a greater need for financial literacy” by BusinessToday, 2021

- “FPAM: Why Financial Literacy is as Important as Financial Knowledge?” by BusinessToday, 2022